When travelling abroad, it should go without saying that managing your finances is crucial to ensure a smooth and hassle-free experience. But such a penny-counting, cost-concerned approach can sometimes run counterintuitively to the kind of spontaneous, free-wheeling holiday that you so richly deserve.

That’s why, increasingly, cash-smart tourists and business travellers are taking the financial headache out of their next holiday by using travel money cards or travel-friendly debit and card cards when making everyday transactions and withdrawals abroad.

In today’s rapidly evolving financial landscape, traditional methods of carrying cash or relying on standard bank cards are becoming outdated. The rise of digital banking and specialized travel cards has revolutionized how we handle money while exploring the world. These innovative financial tools not only offer enhanced security features but also provide real-time tracking of expenses, instant currency conversion, and the flexibility to manage multiple currencies in a single account.

The best prepaid travel and debit cards offer competitive exchange rates, low fees, and often zero overseas ATM fees, making them a popular choice for tourists doing things on a budget and luxury travellers who resent all those additional fees, equally. Whether you’re planning a weekend city break in Europe or embarking on a month-long adventure across continents, having the right travel card can mean the difference between spending your time worrying about transaction fees and fully immersing yourself in the travel experience.

It should be noted that some foreign ATM providers might charge their own fees for using their machines. This means you may still incur additional costs when withdrawing cash abroad. Even so, the smart money is on using a card designed for travel.

With that in mind, today we’re exploring the best UK prepaid travel and debit cards, IDEAL for taking the financial headache out of your next holiday.

Revolut

For frequent travellers seeking convenience and versatility, the Revolut card is a noteworthy contender among the best travel credit cards, offering seamless transactions and efficient currency management.

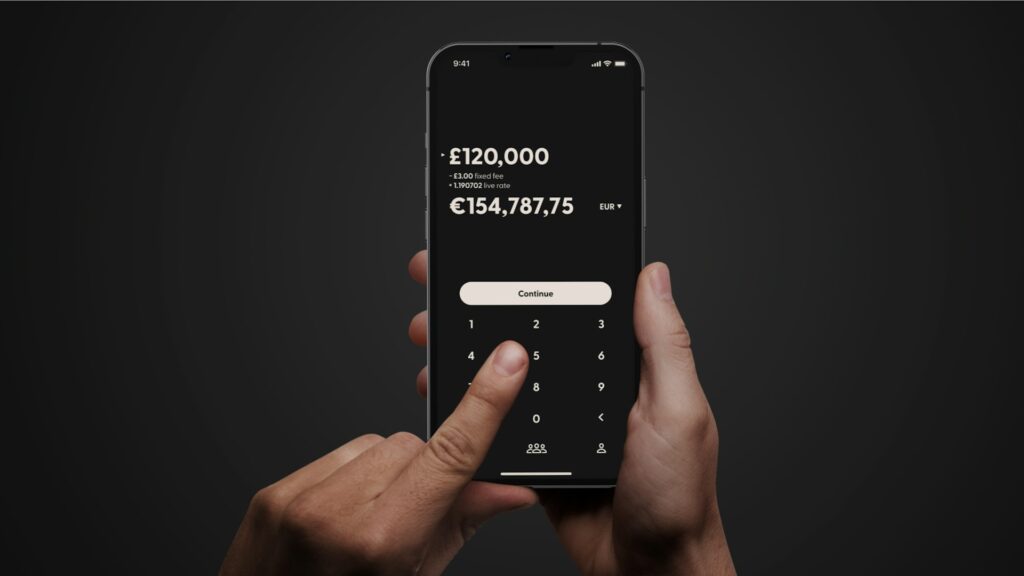

Revolut is a widely-used travel money card that enables users to spend money in more than 150 currencies without incurring fees, as well as being able to hold 28 different currencies on your card. In addition, you can withdraw up to £200 per month from ATMs without any extra charges (or make withdrawals up to 5 times a month – whichever is the first to happen), with a 2% fee applied after that limit.

With a Revolut card, shopping abroad feels simple. It works just like a debit card, so you can pay with it wherever Visa is accepted. All you have to do is top-up your wallet with your debit or credit card, and you can exchange and store up to 28 currencies. Whenever you make a purchase, your card will take the funds from the appropriate currency automatically.

Pros:

– Competitive exchange rates

– No fees for currency conversion

– Instant spending notifications

– Ability to freeze/unfreeze the card via the app

– Budgeting and analytics features

Cons:

– 2% fee for ATM withdrawals over £200 per month, or a limit of five free withdrawals a month

– No cashback or rewards program

– Limited customer support

Wise (formerly TransferWise)

Wise offers a multi-currency account and a contactless Mastercard debit card, allowing users to hold and convert over 50 currencies at the real exchange rate. The card comes with low conversion fees and no transaction fees for most currencies.

Additionally, users can withdraw up to £200 per month from ATMs without incurring any charges. After that, they’ll charge you a fixed fee of £0.50 per transaction. If you take out more than £200 in one month, you’ll be charged an additional 1.75% on top of that.

Pros:

– Transparent and low fees

– Real exchange rate

– Free ATM withdrawals up to £200 per month

– Integration with Apple Pay and Google Pay

Cons:

– 1.75% fee for ATM withdrawals over £200 per month

– No rewards program

– Limited customer support

EasyFX

EasyFX is a prepaid multi-currency Mastercard that allows users to hold and spend in up to 15 currencies, including EUR, USD, AUD, and CAD. The card offers competitive exchange rates and no fees for currency conversion or overseas ATM withdrawals.

That said, when using the prepaid card, you will be charged £6 for a replacement or an additional card, and £25 if you want to investigate a disputed transaction. Paying for your transfer using your bank account can also expose you to a few other charges not controlled by EasyFX.

The card also suffers from some incompatibility with certain payment methods; credit cards, maestro cards, and prepaid cards are not accepted for topping up your EasyFX account. Only Visa and Mastercard debit cards are accepted.

Pros:

– Competitive exchange rates

– No fees for currency conversion or overseas ATM withdrawals

– Mobile app for easy account management

– Instant card lock/unlock feature

Cons:

– Limited number of supported currencies compared to other cards

– No cashback or rewards program

– Charges may apply for certain services, such as card replacement, and there are some compatibility issues

Skrill

Skrill provides a prepaid Mastercard that can be used internationally, offering users the ability to spend in multiple currencies. The card links directly to your Skrill digital wallet, allowing for easy management of funds across different currencies. As one of the pioneering digital payment solutions in Europe, Skrill has established itself as a reliable option for international travelers who need to manage multiple currencies efficiently.

The platform’s integration with its digital wallet service means users can instantly access their funds and make real-time currency conversions, making it particularly useful for frequent travelers or digital nomads who need to manage money across different countries. It also offers fast deposit speeds, making Skrill a preferred payment method for online casinos, interestingly.

The card comes with a sophisticated mobile app that allows users to track spending, manage currency conversions, and receive instant notifications for all transactions. For travelers concerned about security, Skrill offers advanced fraud protection features and 24/7 account monitoring to ensure peace of mind while spending abroad.

Pros:

— Competitive exchange rates

— Real-time transaction notifications

— Instant access to converted funds

— Seamless integration with digital wallet

— Wide international acceptance

Cons:

— Annual card fee may apply

— ATM withdrawal fees higher than some competitors

— Limited customer support options

— Some services may have additional charges

Monzo

Monzo is that most vibrantly coloured of digital banks that offers a contactless Mastercard debit card and a user-friendly mobile app. The card comes with no fees for spending abroad and allows users to withdraw up to £200 per month from ATMs without any charges, with a 3% fee applied after that limit. For this reason, many travellers who prefer a streamlined spending experience (and a slimmer wallet!) choose to use Monzo instead of a prepaid travel card.

What sets Monzo apart in the digital banking landscape is its innovative approach to travel notifications and security features. The app automatically detects when you’re abroad and sends you helpful local spending insights, including real-time currency conversion rates and nearby ATM locations. Additionally, their intelligent fraud detection system adapts to your travel patterns, reducing the likelihood of your card being unnecessarily blocked while maintaining robust security measures.

Pros:

– No fees for spending abroad

– Free ATM withdrawals up to £200 per month

– Real-time spending notifications

– Savings features and budgeting tools

Cons:

– 3% fee for ATM withdrawals over £200 per month

– No multi-currency account or currency conversion features

– No rewards program

Starling Bank

Starling Bank is a digital-only bank offering a contactless Mastercard debit card and a multi-currency account. Users can hold and spend in over 30 currencies and 67 different countries with no fees for currency conversion. Additionally, Starling Bank offers unlimited free ATM withdrawals worldwide.

Additionally, Starling offers 24/7 customer support to assist users with any questions or issues they may encounter while using the service. The bank account also comes with a range of budgeting tools, including real-time spending notifications and categorization of expenses, which can be helpful for travellers looking to manage their money effectively while on the go.

With its user-friendly interface, competitive exchange rates, and fee-free transactions, Starling is a popular choice for those who want a hassle-free way to manage their finances while travelling abroad.

Pros:

– No fees for currency conversion

– Unlimited free ATM withdrawals worldwide

– Integration with Apple Pay, Google Pay, and Samsung Pay

– Real-time spending notifications and budgeting tools

Cons:

– No cashback or rewards program

– Limited customer support

– No option to lock/unlock the card via the app

Caxton FX

Caxton FX offers a prepaid multi-currency Mastercard that allows users to hold and spend in up to 15 currencies, including EUR, USD, AUD, and CAD. The card comes with competitive exchange rates and no fees for currency conversion or overseas ATM withdrawals.

The platform has built a strong reputation among business travelers and holiday makers alike, thanks to its robust currency management system and travel-oriented features. Caxton FX’s rate alert service is particularly noteworthy, allowing users to set target exchange rates and receive notifications when their desired rates become available. This feature helps travelers maximize their currency exchange value by timing their conversions strategically.

Pros:

– Competitive exchange rates

– No fees for currency conversion or overseas ATM withdrawals

– Mobile app for easy account management

– Instant card lock/unlock feature

Cons:

– Limited number of supported currencies compared to other cards

– No cashback or rewards program

– Charges may apply for certain services, such as card replacement

The Bottom Line

When choosing a travel money card, it’s important to consider the exchange rates, fees, and benefits offered by each card to determine which one is best for your specific needs and budget. By using a travel money card or debit card with travel-friendly terms and features, you can manage your money effectively and avoid the high exchange fees and transaction charges often associated with using credit or debit cards abroad.

Now, where will you head to next… The Bahamas, perhaps?