Artificial intelligence (AI) is rapidly transforming our world, offering incredible advances in a range of fields. However, this powerful technology has a darker side, as crafty criminals are increasingly weaponising AI to create scams that are more sophisticated and convincing than ever before.

According to research published by Chums, every 40 seconds, an older person in the UK becomes a victim of fraud, with those over 60 particularly vulnerable to AI-enhanced scams. Research shows more than 1 in 3 people over 65 lack basic internet skills, while 61% of those over 65 report being targeted by financial fraud, making them prime targets for sophisticated AI deception.

And it’s not just the elderly being targeted. With fraud already one the most common crimes in England and Wales – costing the UK a staggering £1.17 billion in 2023 alone – AI is set to make things even trickier. The UK’s National Cyber Security Centre (NCSC) has sounded the alarm, warning that AI will “almost certainly increase the volume and heighten the impact of cyber attacks”.

The accessibility of AI tools means creating realistic fake text, images, audio, and video is now within reach of many, not just highly skilled operatives. This democratisation of scamming techniques means anyone can become a target. The old advice, like looking for poor grammar, often doesn’t cut it anymore as AI can produce flawless content. With all that mind, here’s our IDEAL guide on how to spot these AI-powered cons, recognise the warning signs, and keep your hard-earned cash safe.

The New Wave Of AI Trickery: Scams To Watch For

AI allows criminals to build entire fake worlds, from bogus online shops with AI-generated reviews and chatbot “support,” to perfectly crafted phishing emails.

Deepfakes: When Your Senses Deceive You

Deepfakes – AI-manipulated videos, images, or audio – are a major concern. Scammers can clone a voice from just a few seconds of audio, often lifted from social media. They then use this for ‘emergency’ scams, perhaps a cloned voice of a family member claiming to be in distress and urgently needing money. A shocking 28% of UK adults believe they have been targeted this way in the past year.

In the corporate world, a cloned CEO voice might instruct an employee to transfer funds, leading to huge losses, but it doesn’t stop there. AI can also create videos of people, like fake celebrity endorsements, seemingly backing dodgy investments; the Money Saving Expert Martin Lewis is, perhaps ironically, the most faked celebrity in this type of scam. The Financial Conduct Authority (FCA) frequently warns about these.

Fraudsters also use deepfake clips in romance scams to build fake relationships before asking for money, which can be emotionally damaging just as much as financially.

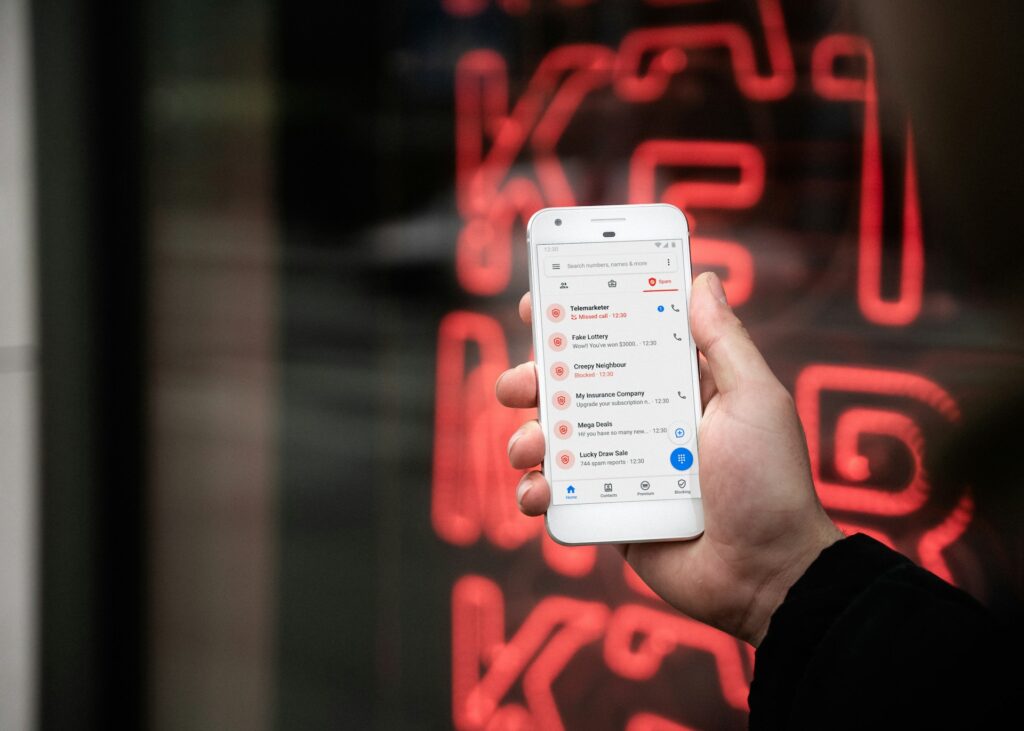

Phishing & Smishing: Smarter & Sneakier

Those scam emails and texts we all seem to receive, once rudimentary and laughably amateurish, have been getting a serious upgrade of late. AI tools can now write flawless, personalised messages that look like they’re from your bank or a government department, complete with logo, correct email address and more, trying to trick you into giving up personal info or clicking dangerous links.

AI-Generated Fakes: Websites, Reviews & Job Offers

Scammers are using AI to build fake shopping websites, too, with AI-written descriptions and reviews, create bogus job offers, sometimes even conducting AI ‘interviews’, all in the name of stealing personal data or fees, and generate fake positive reviews to make their scams look legitimate.

These synthetic shopping websites feature flawlessly written product descriptions, manipulated images, and a chorus of AI-generated customer testimonials singing praises for products that will never arrive. The employment sector hasn’t escaped this digital sleight of hand either, with fabricated job postings leading desperate applicants through convincing AI interviews only to extract personal information or demand payment for non-existent training materials, effectively exploiting hope in times of economic uncertainty.

Chatbot Cons: When ‘Support’ Is A Scammer

Customer service interactions have similarly been weaponised through the deployment of counterfeit AI chatbots that mimic the appearance and conversational patterns of legitimate support systems.

These digital impostors engage users in natural-seeming dialogue, methodically building trust before introducing artificial urgency to extract sensitive credentials, financial information, or personal identification details. The conversation flows with such convincing authenticity that victims often surrender information they would never provide to a stranger, all while the façade of corporate legitimacy lulls them into a false sense of security. As these technologies advance, our best defense remains a healthy skepticism and commitment to verification through official channels we’ve independently accessed.

The Growing AI Threat To Older Adults

As we mentioned in the introduction, AI fraud aimed at the elderly is especially concerning, with a sometimes lack of computer literacy making them prime targets for sophisticated AI deception. The consequences extend beyond financial losses—which totaled over £157 million in just the first half of 2024—to include serious emotional and psychological effects such as depression, anxiety, loss of confidence, and trauma, sometimes leading to loneliness and isolation.

Red Flags: How To Spot The Digital Deceit

While AI makes scams slicker, many classic warning signs still hold true, alongside some new AI-specific clues. Always be wary if there’s pressure to act urgently, demands for payment by unusual methods like gift cards or cryptocurrency, or if you receive unexpected contact asking for sensitive information. If an offer sounds too good to be true, it probably is.

For deepfakes, look for unnatural facial movements, weird blinking, skin that’s too smooth or blurry, inconsistent lighting, or poor lip-syncing. Hands and hair can also look a bit off. With voice clones, listen for robotic or emotionless tones, strange pauses, or speech patterns that don’t sound like the person you know.

An unexpectedly flawless, highly personalised email from an unknown source can also be a warning. Always check sender email addresses carefully and hover over links before clicking.

Your Defence Plan: How To Stay Safe

A multi-layered defence is your best bet. The golden rule, echoed by government campaigns, is to Stop, Think, Verify. If something feels off, pause. Question it – could it be fake? It’s okay to say no or ignore requests. If you think you’ve been scammed, contact your bank immediately and report it to Action Fraud.

If a message or call seems suspicious, even from a known contact, verify it through a separate, trusted channel. Call your family member back on their usual number, or find a company’s official contact details online.

Boost your digital defences by using strong, unique passwords for every account (a password manager can help) and enabling on all important accounts. Keep your software and apps updated and use reputable antivirus software.

Be wary of unsolicited messages on social media. Limit the personal information, images, and voice recordings you share publicly, as scammers use this to personalise their attacks.

When it comes to investments, always check if a financial firm is authorised by the FCA via their official register before investing. Be sceptical of unsolicited investment offers promising high returns, especially those using AI buzzwords or featuring celebrity endorsements on social media, as these are often deepfakes.

To protect elderly loved ones, establish a ‘safeword’ among family members that can verify identity during emergency calls. Additionally, enable two-factor authentication on important accounts, even for those without smartphones—many services offer landline verification or separate security devices. Remember that feeling embarrassed after being scammed is common, but blame belongs solely with the fraudster.

If you suspect you’ve been scammed, contact your bank immediately using the official number on their website or the back of your card. They might be able to stop payments or recover funds. You can also call 159 to be connected securely to most major banks. Change any compromised passwords immediately.

The Bottom Line

AI is a game-changer for both work and play, but with knowledge and caution, you can navigate its challenges. By understanding the tactics, spotting the red flags, and taking proactive steps, you can significantly reduce your risk. Remember to stay informed, share this advice, and always trust your instincts. If something feels wrong, it probably is.